Unveiling the Destructive Power of Family Wealth: A Comprehensive Examination of Its Impact on Individuals and Society

4.7 out of 5

| Language | : | English |

| File size | : | 510 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 295 pages |

| Lending | : | Enabled |

: Unveiling the Hidden Consequences

Family wealth, often perceived as a blessing, holds a surprising hidden side. While it can provide financial security and opportunities, it can also wield a destructive power that reverberates through generations. This article delves into the multifaceted effects of family wealth, shedding light on its detrimental impact on individuals, families, and society.

The Psychological Toll: Uncovering the Inner Turmoil

In the realm of psychology, family wealth has been linked to a constellation of negative outcomes. Individuals born into wealthy families may experience:

- Entitlement and Narcissism: A sense of superiority and disregard for others, leading to social isolation and relationship problems.

- Anxiety and Depression: The pressure to maintain wealth and meet family expectations can trigger mental health issues.

- Lessened Empathy: Constant exposure to material possessions and privilege can erode empathy towards those less fortunate.

- Impaired Social Skills: Focus on wealth acquisition may result in neglected social development, leading to difficulties in forming meaningful relationships.

Intergenerational Transmission: Passing Down the Burden

The destructive effects of family wealth are not confined to the individual. They are often transmitted from one generation to the next. Inheriting wealth without proper preparation can lead to:

- Financial Irresponsibility: Lack of financial literacy and life experiences can result in reckless spending and poor investment decisions.

- Diminished Work Ethic: The perception of wealth as an automatic safety net can reduce motivation to pursue careers or develop skills.

- Relationship Problems: Differences in wealth can create tension between family members and lead to unequal power dynamics.

- Substance Abuse: The stress and boredom associated with wealth may drive some individuals towards unhealthy coping mechanisms.

Societal Implications: The Ripple Effects on Community

The destructive power of family wealth extends beyond the confines of individual families. It can have far-reaching societal consequences:

- Increased Social Inequality: Concentration of wealth in the hands of a few can widen the wealth gap and exacerbate social divisions.

- Erosion of Meritocracy: Inheritance-based wealth can undermine the principles of meritocracy and equal opportunity.

- Reduced Social Mobility: Financial advantages can create barriers to social mobility, perpetuating existing inequalities.

- Distortion of Philanthropy: Wealthy families may use philanthropy as a means to maintain social status or gain influence, diluting the true spirit of giving.

Mitigating the Destruction: Strategies for Responsible Wealth Management

Recognizing the potential pitfalls of family wealth, it is imperative to adopt strategies for responsible management. These include:

- Education and Financial Literacy: Educating family members about financial planning, investing, and responsible spending is crucial.

- Delayed Inheritance and Gradual Transfers: Distributing inheritance gradually over time allows heirs to develop experience and maturity.

- Trusts and Foundations: Utilizing trusts and foundations can provide a structured framework for managing wealth and promoting its responsible use.

- Philanthropy with Purpose: Encouraging family members to engage in meaningful philanthropy that aligns with their values and benefits society.

- Open Communication and Family Governance: Fostering open communication and establishing clear family governance rules can prevent wealth-related conflicts.

: Embracing a Balanced Approach

Family wealth, while offering potential benefits, should not be seen as an unmitigated blessing. It is essential to acknowledge its destructive potential and take proactive steps to mitigate its negative effects. By embracing responsible wealth management strategies, we can harness its power for good while safeguarding the well-being of individuals, families, and society as a whole.

Call to Action: Promoting Awareness and Responsible Stewardship

Unveiling the destructive power of family wealth is not just an academic exercise. It is a call to action. We must raise awareness about its potential consequences and advocate for responsible stewardship of wealth. By fostering open dialogue, educating future generations, and implementing sound management practices, we can transform the narrative surrounding family wealth and ensure it becomes a force for positive impact on individuals and society.

Frequently Asked Questions

Q: Is all family wealth destructive?

A: No, not all family wealth is destructive. When managed responsibly, it can provide financial security and opportunities for individuals and families. However, it is important to be aware of its potential negative consequences and take steps to mitigate them.

Q: How can I prepare my children for inheriting wealth responsibly?

A: Education is key. Teach your children about financial planning, investing, and responsible spending from a young age. Gradual inheritance and the establishment of family governance rules can also help prepare them for the challenges and opportunities that come with wealth.

Q: What are the societal benefits of responsible wealth management?

A: Responsible wealth management can promote social equality, enhance meritocracy, increase social mobility, and foster meaningful philanthropy. It can also contribute to a more just and equitable society.

Additional Resources

- Website 1: The Psychology of Wealth

- Website 2: The Intergenerational Transmission of Wealth

- Website 3: Strategies for Responsible Wealth Management

4.7 out of 5

| Language | : | English |

| File size | : | 510 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 295 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Greg Sushinsky

Greg Sushinsky Heather Hamilton Senter

Heather Hamilton Senter Luigi Pirandello

Luigi Pirandello E E Rawls

E E Rawls Dalton Fury

Dalton Fury Joseph Conrad

Joseph Conrad Boyd Craven Iii

Boyd Craven Iii Bernard Knight

Bernard Knight Shalese Heard

Shalese Heard Laurence Leamer

Laurence Leamer Philip Richardson

Philip Richardson James Arthur

James Arthur William C Kirby

William C Kirby Robert Richard

Robert Richard Todd Whitaker

Todd Whitaker Graham Greene

Graham Greene Andrew Davis

Andrew Davis Wallace Fowlie

Wallace Fowlie Mark R Anspach

Mark R Anspach Native Plant Trust

Native Plant Trust

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Darnell MitchellThe El Campeador Reconquista Chronicles: A Historical Epic of Valour and...

Darnell MitchellThe El Campeador Reconquista Chronicles: A Historical Epic of Valour and... Ryan FosterFollow ·8.7k

Ryan FosterFollow ·8.7k Matthew WardFollow ·3k

Matthew WardFollow ·3k Cade SimmonsFollow ·18k

Cade SimmonsFollow ·18k Mario Vargas LlosaFollow ·10.6k

Mario Vargas LlosaFollow ·10.6k Chad PriceFollow ·5.6k

Chad PriceFollow ·5.6k Julio Ramón RibeyroFollow ·11.1k

Julio Ramón RibeyroFollow ·11.1k Robbie CarterFollow ·9.6k

Robbie CarterFollow ·9.6k Ethan MitchellFollow ·14.1k

Ethan MitchellFollow ·14.1k

Rex Hayes

Rex HayesWorld of Dead Volume Issue: An In-Depth Analysis

The World of Dead volume issue...

Nathan Reed

Nathan ReedHard Lessons Learned from ERP Rollouts: A Hivemind...

Enterprise...

Fernando Bell

Fernando BellWith the Light, Vol. 1: Illuminating the Extraordinary...

The advent of parenthood is a...

Wesley Reed

Wesley ReedNo Helping Hand: True Story of Deadly Waves

In December 2004,...

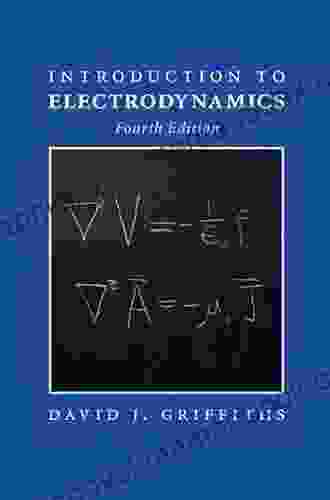

Ruben Cox

Ruben CoxIntroduction to Electrodynamics by David Griffiths: A...

to Electrodynamics by...

4.7 out of 5

| Language | : | English |

| File size | : | 510 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 295 pages |

| Lending | : | Enabled |